You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

eBucks

- Thread starter biometrics

- Start date

Yeah, just extra hassle though. I was fine for 2021 now I have to make a plan again like every damn year.

I have to stay on Private Client as I get an extra 0.25% off on my bond(s). Else I'd go to Premier again for the easy points. Earn about the same anyway in my case.

That's interesting. I'm also PC and am thinking about moving my bond over to FNB. Need to get a quote I guess.

biometrics

Well-Known Member

- Joined

- Oct 17, 2019

- Messages

- 20,320

I moved from Standard to FNB last year and got a better rate.That's interesting. I'm also PC and am thinking about moving my bond over to FNB. Need to get a quote I guess.

That extra 0.25% requires you to be PC but also your salary needs to be paid into your Fusion account (they call it "main banked"). Worth it though. Hermanus bond is currently prime - 1.08%.

Also you get the initiation fee of R6,000 back in eBucks after the first payment.

biometrics

Well-Known Member

- Joined

- Oct 17, 2019

- Messages

- 20,320

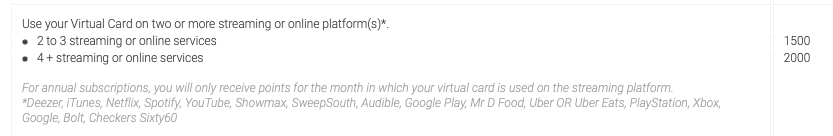

I'm pretty sure the * refers to the platforms listed beneath that qualify for the points. I get points every month and I don't meet that criteria you posted.

View attachment 33135

Is the SO with FNB?

Refering to the 40% not the points.

Wow, that's news. SO isn't with FNB but my 16 year old has an FNBy linked to my profile so that covers it I guess

biometrics

Well-Known Member

- Joined

- Oct 17, 2019

- Messages

- 20,320

Fecker. Will figure out next month where to gain points. Might drop the savings account deposit and get some streaming.Wow, that's news. SO isn't with FNB but my 16 year old has an FNBy linked to my profile so that covers it I guess

I moved from Standard to FNB last year and got a better rate.

That extra 0.25% requires you to be PC but also your salary needs to be paid into your Fusion account (they call it "main banked"). Worth it though. Hermanus bond is currently prime - 1.08%.

Also you get the initiation fee of R6,000 back in eBucks after the first payment.

I just got the new bond through SA Homeloans for convenience as I was already with them, but other house sale is due to go through on the 15th and it was always my intention to check out FNB when that was sold.

Also, pro tip.

When you take out a new bond, always make payment date first of the month. When you are selling and have a transfer date I always go for middle of the month, then I call the bond people and ask them to change the bond payment date to the 28th of the month. I've done it a few times now including this sale

Fecker. Will figure out next month where to gain points. Might drop the savings account deposit and get some streaming.

I should add, my 16 year old doesn't use the account. I just top it up with R300 a month and use it as a savings account.

biometrics

Well-Known Member

- Joined

- Oct 17, 2019

- Messages

- 20,320

Explain, I'm not getting it.Also, pro tip.

When you take out a new bond, always make payment date first of the month. When you are selling and have a transfer date I always go for middle of the month, then I call the bond people and ask them to change the bond payment date to the 28th of the month. I've done it a few times now including this sale

Explain, I'm not getting it.

When you make your monthly payment your bond goes down by a fraction of that amount. So my bond was about R14k a month and the total owed only went down by about R5k iirc. So I lose about R9k a month to interest and fees.

Soooo, this month with my transfer going through on the 15th, I called SA Homeloans last month and changed my payment date from the first of every month to the 28th. So instead of my payment of R14k coming off and my balance showing a decrease of R5k on the 1st June, I scored a whole payment of R14k and saved R9k because the payment date was th 28th and the house is sold before that.

That's harder to explain than I thought but do you catch my drift?

biometrics

Well-Known Member

- Joined

- Oct 17, 2019

- Messages

- 20,320

He he, don't think it works that way. Interest is calculated daily.When you make your monthly payment your bond goes down by a fraction of that amount. So my bond was about R14k a month and the total owed only went down by about R5k iirc. So I lose about R9k a month to interest and fees.

Soooo, this month with my transfer going through on the 15th, I called SA Homeloans last month and changed my payment date from the first of every month to the 28th. So instead of my payment of R14k coming off and my balance showing a decrease of R5k on the 1st June, I scored a whole payment of R14k and saved R9k because the payment date was th 28th and the house is sold before that.

That's harder to explain than I thought but do you catch my drift?

He he, don't think it works that way. Interest is calculated daily.

They never took the R14k from my bank account last week. To me that’s a win

biometrics

Well-Known Member

- Joined

- Oct 17, 2019

- Messages

- 20,320

Sure, but the conveyancing attorneys will sort that out...They never took the R14k from my bank account last week. To me that’s a win

Sure, but the conveyancing attorneys will sort that out...(been there, they are spot on)

I’ve done this about 4 times now over the years and that money in my bank is a nice win. I’d actually be interested to know how much the win is but I’m sure there is a win even if a little.

biometrics

Well-Known Member

- Joined

- Oct 17, 2019

- Messages

- 20,320

The bank sends the settlement to the conveyancing attorney so they'll get their money at the end. Guess I don’t understand, but I seriously doubt you can score R14k off them.I’ve done this about 4 times now over the years and that money in my bank is a nice win. I’d actually be interested to know how much the win is but I’m sure there is a win even if a little.

biometrics

Well-Known Member

- Joined

- Oct 17, 2019

- Messages

- 20,320

In on calculator.

In on calculator.

What's happened to all of the 40% deals? Seriously miffed that I've got a whack load of eBucks after a disappointing Black Friday last year and I'm waiting on some 40% deals on a Macbook or something to spend them on, but nothing for months.

biometrics

Well-Known Member

- Joined

- Oct 17, 2019

- Messages

- 20,320

Haven't bothered with the 40% discounts in years. I just spend it each month on groceries with Takealot.What's happened to all of the 40% deals? Seriously miffed that I've got a whack load of eBucks after a disappointing Black Friday last year and I'm waiting on some 40% deals on a Macbook or something to spend them on, but nothing for months.

Haven't bothered with the 40% discounts in years. I just spend it each month on groceries with Takealot.

I was saving for last years BF and never spend them all (although I got an iPhone for SO at 40% off), and just kept going hoping for something good to come along. My MB Air is seriously failing battery wise so I thought I'd hang on for a new one at 40% off, but nothing is coming. Now I've got enough to buy one outright, but knowing my luck as soon as I spend then one will come at 40% straight after

biometrics

Well-Known Member

- Joined

- Oct 17, 2019

- Messages

- 20,320

Surely a battery replacement is much much cheaper?I was saving for last years BF and never spend them all (although I got an iPhone for SO at 40% off), and just kept going hoping for something good to come along. My MB Air is seriously failing battery wise so I thought I'd hang on for a new one at 40% off, but nothing is coming. Now I've got enough to buy one outright, but knowing my luck as soon as I spend then one will come at 40% straight after